Yahoo Finance

Getting stock prices with Pandas is very easy. Ensure you have pandas_datareader, which can be installed with pip install pandas_datareader, then make your imports if you wish to follow along with this article.

import pandas_datareader.data as web

import pandas as pd

import datetime as dt

import matplotlib.pyplot as plt

plt.style.use('ggplot')

The first source we will use for this article is Yahoo Finance, generally the data from Yahoo is of good quality, with an added bonus of being 100% free and no sign up required! There are a minimum of four options we must specify in order to download the data.

#start of the data

start = dt.datetime(2010,1,1)

#last data point to download

end =dt.datetime(2020,1,1)

# name of the stock symbol

symbol = 'AAPL' ###using Apple as an example

##source of the data

source = 'yahoo'

# pass in the arguments above to pandas datareader

data = web.DataReader(symbol, source, start, end)

##view first 5 rows of the data

data.head()

Running the script above should return the following in your console:

High Low Open Close Volume Adj Close

Date

2010-01-04 30.642857 30.340000 30.490000 30.572857 123432400.0 26.538483

2010-01-05 30.798571 30.464285 30.657143 30.625713 150476200.0 26.584366

2010-01-06 30.747143 30.107143 30.625713 30.138571 138040000.0 26.161509

2010-01-07 30.285715 29.864286 30.250000 30.082857 119282800.0 26.113146

2010-01-08 30.285715 29.865715 30.042856 30.282858 111902700.0 26.286753

If you get an error similar to the following:

RemoteDataError: No data fetched for symbol AAPffL using YahooDailyReader

This likely means you have typed in the stock symbol incorrectly. If the stock symbol is in fact correct it is also possible you have incorrectly specified the country suffix, for instance let's take a look at BMW which is a German company. Check out the Yahoo Finance page here, notice that the stock the information is structured as follows:

Bayerische Motoren Werke Aktiengesellschaft (BMW.DE)

So for German based companies we must append .DE to the symbol.The same is true for British based companies in that a .L must be appended to the symbol in order to download it correctly.

The error below relates to an incorrect specification of the data source.

NotImplementedError: data_source='yahgoo' is not implemented

Going back to the example of Apple's stock data, say for instance you only wanted to download the adjusted close as opposed to the high, low, volume etc, you can specify this as follows:

data = web.DataReader(symbol, source, start, end)['Adj Close']

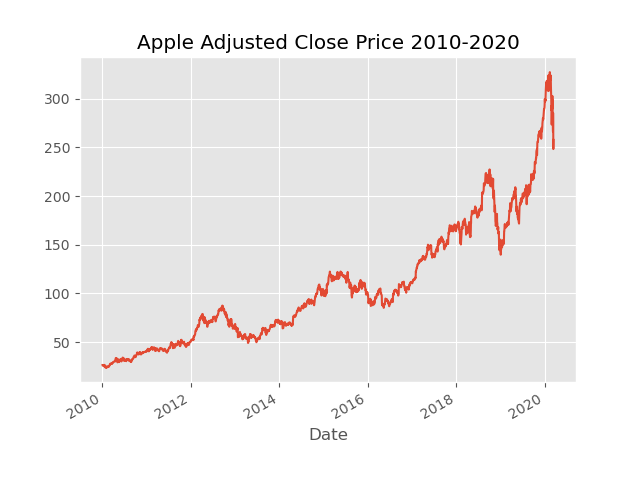

It is usually a good idea to plot the data to investigate any obvious errors or suspiciously large moves in the price.

data = web.DataReader(symbol, source, start, end)['Adj Close']

data.plot()

plt.title('Apple Adjusted Close Price 2010-2020')

Quandl

Quandl is another great choice for getting high quality data. You will need to install their Python package with pip install quandl in your terminal / console. You don't need an account to get up to 50 API calls / day from Quandl. However, I do recommend getting a free account as they have lots of interesting free data sets, and they don't email spam!

Make the following imports:

import quandl

import pandas as pd

import datetime as dt

import matplotlib.pyplot as plt

plt.style.use('ggplot')

The syntax for downloading data from Quandl is similar to Yahoo Finance, however specifying a start date isn't required, if you don't specify a start date Quandl will simply return all available data when you reference a security. Let's try with Apple:

data = quandl.get('WIKI/AAPL')

data.head()

The "WIKI" here refers to the database on Quandl followed by the security name, I encourage you to check out their website for a full list of datasets available. Quandl returns a number of columns not present in Yahoo Finance, this may be more useful depending on what you need to do with the data.

data.head() shows

Open High Low ... Adj. Low Adj. Close Adj. Volume

Date ...

1980-12-12 28.75 28.87 28.75 ... 0.422706 0.422706 117258400.0

1980-12-15 27.38 27.38 27.25 ... 0.400652 0.400652 43971200.0

1980-12-16 25.37 25.37 25.25 ... 0.371246 0.371246 26432000.0

1980-12-17 25.87 26.00 25.87 ... 0.380362 0.380362 21610400.0

1980-12-18 26.63 26.75 26.63 ... 0.391536 0.391536 18362400.0

To see the full list of columns returned by Quandl type the following:

print(data.columns)

Index(['Open', 'High', 'Low', 'Close', 'Volume', 'Ex-Dividend', 'Split Ratio',

'Adj. Open', 'Adj. High', 'Adj. Low', 'Adj. Close', 'Adj. Volume'],

dtype='object')

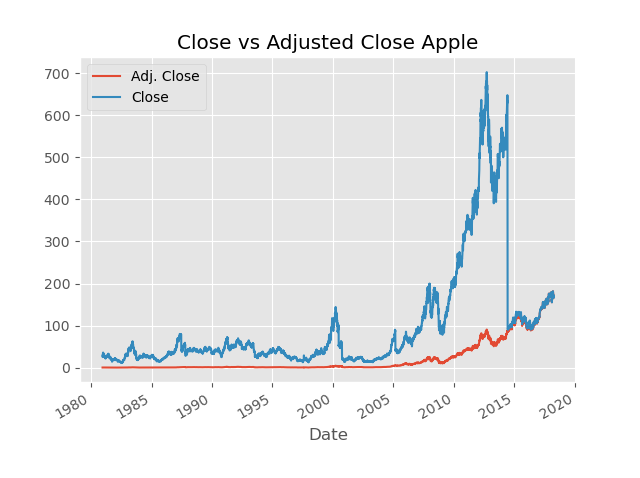

Let's plot the 'Adj. Close' vs the 'Close' columns to illustrate why you should be careful when selecting which to work with.

data['Adj. Close'].plot()

data['Close'].plot()

plt.legend()

plt.title("Close vs Adjusted Close Apple")

plt.show()

More than a little different right? A short explanation of this is that the adjusted close price takes dividends and stock splits into account. So depending on what you are doing with the data, you should choose the column of interest carefully.